Understanding Just How Credit Repair Work Functions to Improve Your Financial Health And Wellness

The procedure incorporates identifying errors in credit history records, disputing errors with debt bureaus, and bargaining with lenders to address exceptional financial obligations. The inquiry remains: what particular methods can people employ to not only rectify their credit report standing however additionally ensure lasting financial stability?

What Is Credit Score Repair?

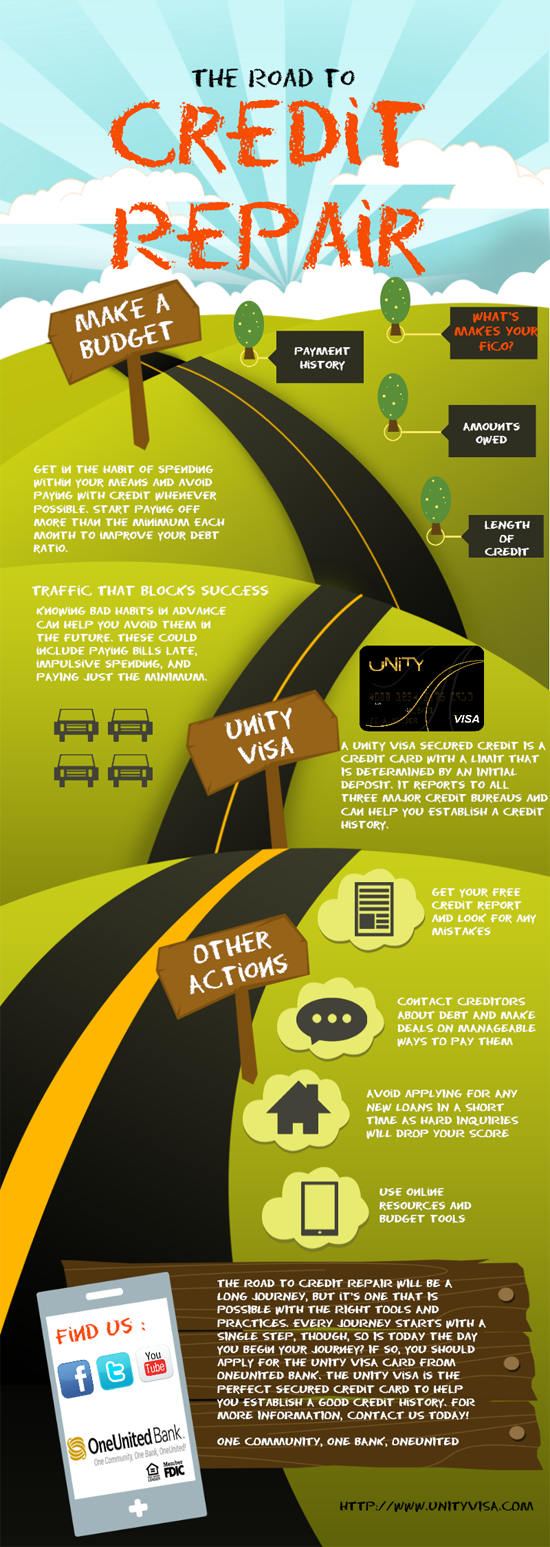

Credit scores repair service describes the process of improving an individual's credit reliability by dealing with errors on their credit rating report, bargaining debts, and adopting far better financial habits. This multifaceted approach aims to boost an individual's credit report, which is an important factor in safeguarding fundings, charge card, and positive rates of interest.

The credit rating repair procedure commonly begins with a comprehensive testimonial of the individual's debt report, permitting for the recognition of any kind of disparities or errors. As soon as mistakes are pinpointed, the individual or a debt repair service specialist can initiate disagreements with debt bureaus to remedy these concerns. Additionally, bargaining with creditors to clear up arrearages can better boost one's financial standing.

Moreover, adopting prudent economic techniques, such as prompt expense settlements, reducing credit report utilization, and preserving a varied credit report mix, adds to a much healthier credit scores account. Overall, debt fixing works as a necessary strategy for people seeking to gain back control over their economic health and wellness and protect much better borrowing chances in the future - Credit Repair. By taking part in debt repair work, people can lead the way towards achieving their financial goals and improving their overall high quality of life

Common Credit Score Record Errors

Mistakes on credit history records can dramatically affect an individual's credit score, making it crucial to comprehend the typical types of mistakes that may develop. One common problem is inaccurate personal information, such as misspelled names, wrong addresses, or inaccurate Social Protection numbers. These mistakes can cause complication and misreporting of credit reliability.

Another usual mistake is the reporting of accounts that do not belong to the person, usually due to identity burglary or clerical blunders. This misallocation can unfairly reduce a person's credit rating score. In addition, late payments may be inaccurately taped, which can occur as a result of settlement handling mistakes or wrong coverage by lenders.

Credit line and account balances can likewise be misstated, causing an altered sight of a person's credit rating usage ratio. Furthermore, obsolete info, such as shut accounts still looking like active, can adversely impact credit scores examinations. Public records, consisting of insolvencies or tax obligation liens, may be incorrectly reported or misclassified. Recognition of these common mistakes is crucial for reliable credit management and repair work, as resolving them quickly can aid people keep a healthier monetary account.

Actions to Disagreement Inaccuracies

Challenging inaccuracies on a credit score record is a vital procedure that can assist bring back a person's creditworthiness. The primary step includes acquiring a present duplicate of your credit rating report from all 3 significant credit history bureaus: Experian, TransUnion, and Equifax. Evaluation the report diligently to recognize any kind of errors, such as incorrect account information, balances, or settlement histories.

Next off, start the disagreement process by speaking to the appropriate credit bureau. When sending your dispute, plainly describe the mistakes, provide your proof, and consist of personal identification information.

After the conflict is submitted, the credit rating bureau will investigate the insurance claim, typically within thirty days. They will certainly connect to the creditor for confirmation. Upon conclusion of their examination, the bureau will educate you of the outcome. They will certainly remedy the report and send you an updated duplicate if the disagreement is resolved in your favor. Keeping exact documents throughout this process is necessary for effective resolution and tracking your credit history health and wellness.

Building a Solid Debt Account

Exactly how can individuals efficiently grow a robust credit report account? Constructing a strong credit history account is essential for securing positive monetary chances. The structure of a healthy and balanced debt profile begins with prompt expense settlements. Consistently paying bank card expenses, financings, and various other obligations promptly is critical, as settlement background significantly affects credit history scores.

Additionally, preserving reduced credit rating utilization proportions-- preferably under 30%-- is essential. This means keeping bank card equilibriums well listed below their restrictions. Expanding credit score types, such as a mix of revolving credit rating (charge card) and installation lendings (auto or home loans), can also enhance credit rating accounts.

Consistently keeping track of credit report reports for errors is similarly essential. People should review their credit report records at the very least yearly to recognize disparities and contest any kind of mistakes promptly. In addition, Click Here avoiding too much credit queries can prevent potential negative effect on credit history.

Lasting Advantages of Credit Rating Fixing

Moreover, a more powerful credit rating account can promote far better terms for insurance policy premiums and even affect rental applications, making it simpler to protect real estate. The psychological benefits ought to not be ignored; individuals who effectively fix their credit commonly experience lowered tension and enhanced confidence in handling their finances.

Final Thought

In conclusion, credit repair work offers as an important device for improving financial health. By recognizing and contesting inaccuracies in credit rating reports, individuals can remedy errors that negatively impact their credit history ratings.

The lasting benefits of credit history repair service prolong far past just boosted debt ratings; they can significantly improve an individual's general monetary health.